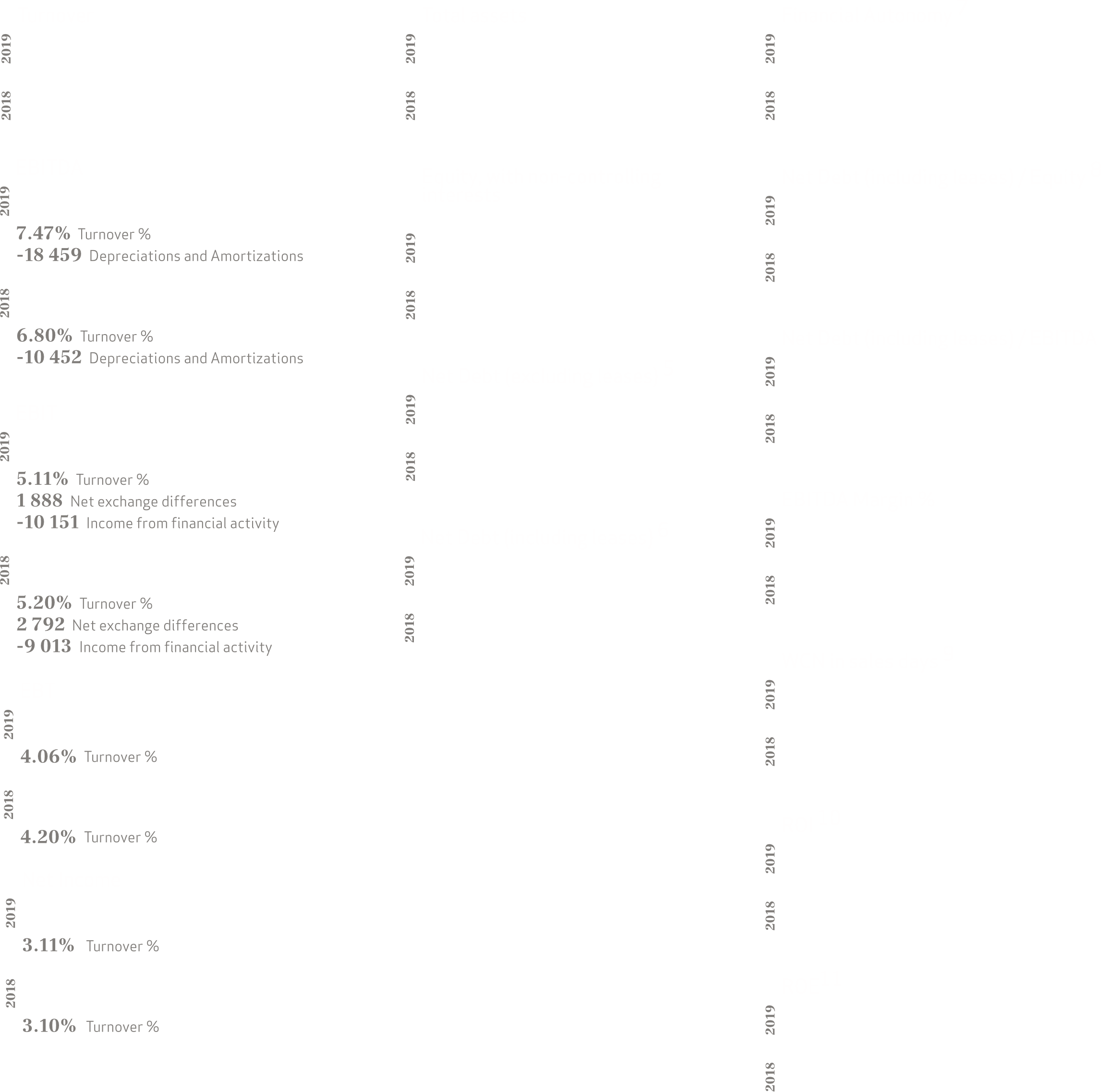

1. Sales + provision of services + own work capitalized, aggregating 100% of joint ventures.

2. Number of Employees, aggregating 100% of joint ventures.

3. Sales +provision of services +own work capitalized, consolidated.

4. The Group’s consolidated EBITDA, which allocates the Net Income from join ventures according to the share of capital held.

5. Financing obtained — cash and bank deposits — ready-for-sale investments.

6. Financing obtained + operating leases liabilities — cash and bank deposits — ready-for-sale investments.

7. Equity with non-controlled interests / Net asset.

8. Net debt (net borrowing + lease liabilities – ready-for sale investments) / Equity in non-controlled assets.

9. (Clients, Inventories, Other receivables, State, Stakeholders, Suppliers e Other outstanding balances) / Turnover multiplied by 365 days.

10. Ebit / Invested Capital [Total Equity + obtained funding + lease liabilities– cash and cash equivalents– ready-for-sale investments]

11. Net income from the parent company’s ongoing operations / Equity minus Net income and non-controlled interests.

2019 was the first year applying IFRS 16, the impacts of which are mentioned further in chapter 4