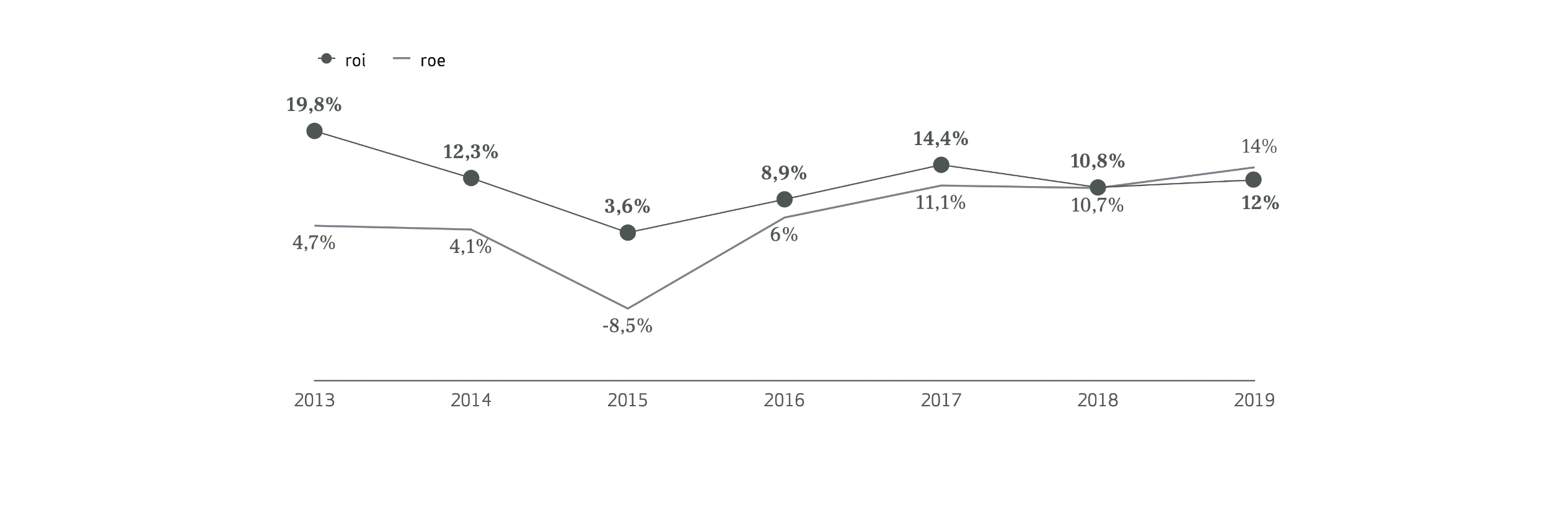

Financial ratios in 2019

With the upward trajectory of recent years reinforced, the turnover registered a 21.5% growth, reaching a consolidated total of 782.7 million dollars. This overall performance is primarily based on an activity rise in the Brazilian market, as well as the contribution of Portugal, Angola, and other countries in the African Region.

In Brazil, 2019 confirmed and strengthened the growth trend initiated in 2018. We achieved a 50% increase in sales, a figure that would have had a more significant impact if not for the adverse exchange rate effect.

In Portugal, 2019 was a year marked by stability in the high range truck market, having evolved positively only by 2% (4,410 units in 2019 when compared with 4,307 units in 2018). It was also a year where we committed to different projects that will allow our companies to evolve and redefine their business models, preparing themselves for future paradigm changes.

Despite the growth in its turnover, the Angolan market remains significantly conditioned by the situation that has been lived since 2015. The severe exchange rate devaluation suffered by the Kwanza during the year — induced to stop inflation — took the purchasing power away from the economic agents. This phenomenon, paired with a near absence of investment, determined yet another year of great apathy in the economy as a whole, but also in our sector, in particular.

Our global turnover growth also materialized in an increase in the generated gross margin. In fact, this indicator went from 117.4 million euros in 2018 to 132.6 million euros in 2019, mainly due to the excellent performance of Brazil’s operations. On the other hand, the gross margin percentage decreased, a phenomenon that can be explained by the shift in the business mix and respective contribution to its margin.

In Brazil, the expansion cycle underlies our growth in the sale of equipment, which is the business area with the least contribution to the margin. In Angola, the continuation of the economic slowdown and the erosion of the circulating park extended the After Sales business breakdown, the business area with the highest contribution to the margin.

This increase in the generated gross margin, combined with a stable cost structure, led to a rise in EBITDA from 44 million euros in 2018 to 58.5 million euros in 2019. This evolution includes the positive impact resulting from applying IFRS 16 in the amount of 8.2 million euros. Along with the EBITDA increase, it should be noted the EBITDA qualitative evolution regarding its origin.

Despite the pressure that the growth in activity places on the capital employed, without the effects of the application of IFRS 16, Nors would once more register a reduction in net debt, going from 98.7 million euros in 2018 to 72.1 million euros in 2019. This decrease is mainly associated with the production of operational cash flow. Still, we cannot fail to mention the positive contribution of selling non-strategic assets — similar to what has been done in recent years — and that in 2019 determined the sale of the company Biosafe (3.1 million euros).

As a result of the lower consumption of the financial debt, associated with a more favorable average price, the interested invoice effectively decreased. Nonetheless, the value reported in Income from Financial Activity is negatively impacted by the effects of IFRS 16 — without which it would total -7.6 million euros.

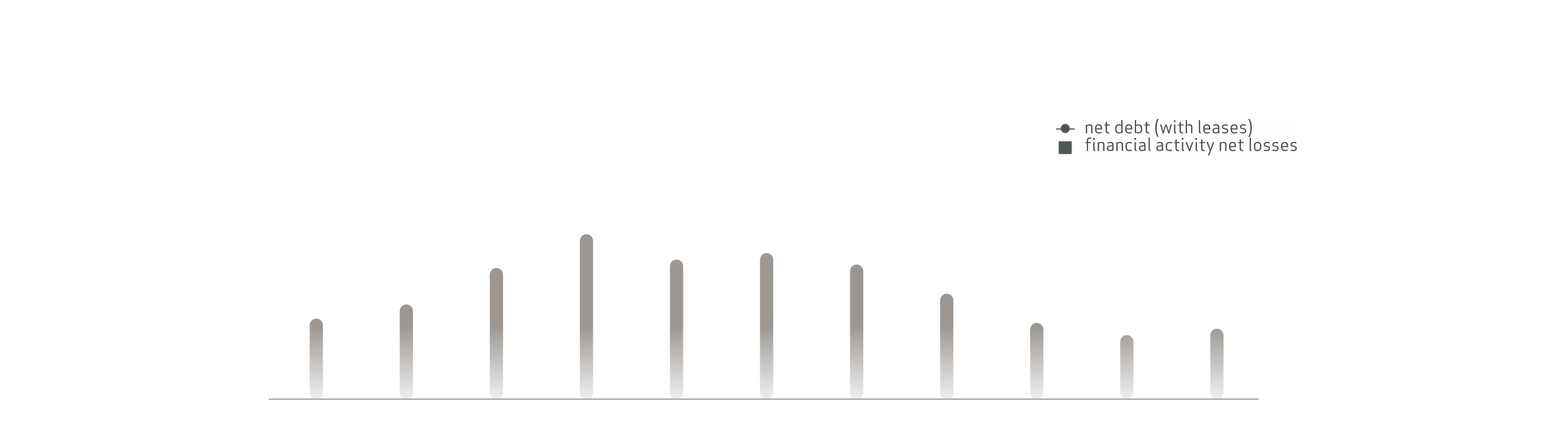

As shown in the graph below, combining the effects of EBITDA and the net debt with leases allowed it to reduce its respective ratio. The effects of IFRS 16 also impacted this ratio — otherwise, it would be 1.8.

We effectively managed the currency impacts coming from Angola, caused by our exposure to the Kwanza devaluation risk, and the United States Dollar. The first risk was eliminated by using Treasury bonds of the Angolan State, whose valuation is indexed to the United States Dollar. The second risk was managed through a natural hedging strategy, achieved by creating financial liabilities denominated in United States dollars.

The growth in EBITDA offset the slight increase in expenses related to the financial activity, allowing us to close 2019 with a growth in net income — which rises to 24.3 million euros in 2019.

Benefiting from this performance, the equity balance sheet item grew. We also recorded a growth in Net Assets — from 560.3 million euros in 2018 to 671.1 million euros in 2019 — justified by the introduction of IFRS 16, which directly caused a 33.8 million euros increase. Nevertheless, we were able to maintain our financial autonomy practically unchanged compared to 2018, without which the ratio in question would amount to 35.7%.

Profitability ratios were also affected by the introduction of IFRS 16. The net result was negatively impacted by 0.7 million euros due to IFRS 16 – without which ROE would be 14.4%.

On the other hand, EBIT had a positive impact of 1.5 million euros (an increase of 8.2 million euros in EBITDA and an increase in depreciation of 6.7 million euros). Thus, without the result of this effect, ROI would be 12.9%. In summary, regarding profitability ratios, ROE grew from 10.7% to 14% and ROI from 10.8% to 12%.

Turnover

Our turnover comes from a diversified portfolio of operations, geographically disperse, and that allows us to incorporate and mitigate different risks associated with regional economic cycles. In 2019, this indicator recorded a 21.5% growth, which is equivalent to 138 million euros. This increase results from a different composition of contributions by region to the consolidated performance. The favorable variations arise from Brazil, Angola, Portugal, and Africa Region. The distribution of turnover according to each region and business is as follows:

Gross margin

In 2019, we recorded a higher gross margin in value, reaching 132.6 million euros (16.9%) compared to 117.4 million euros (18.3%) in 2018. The decrease in the percentage margin is directly associated with greater relevance of the chassis sale in the turnover, with lower margins than those obtained in activities related to After Sales.

Ebitda

We registered, in 2019, an EBITDA of 58.5 million euros, which corresponds to an increase of 14.4 million euros (+32.8%) in comparison with the one achieved in 2018. A higher gross margin value caused this growth, mainly sustained by the increase in sales in Brazil’s operations. The EBITDA generated in 2019 includes the effect of IFRS 16 in the amount of 8.2 million euros.

Net income

We ended 2019 with a Net Profit of 24.3 million euros, resulting in an increase of 4.3 million euros (+21.6%) compared to the previous year. This result was negatively impacted by the introduction of IFRS 16 in 0.7 million euros.

Our consolidated assets are worth over 617.2 million euros, which, compared to the amount registered at the end of 2018, corresponds to a 56.8 million euros (+10%) increase, of which 33.8 million results from the application of IFRS 16.

Capital Employed

In line with the strategy initiated in 2015, in 2019, we continued to carefully monitor the allocation of resources to our businesses located in different geographies. The application of IFRS 16 had a negative impact (an increase of 33.8 million euros in capital employed), contributing to the 15.4% increase in capital employed by Nors in 2019. In different circumstances, Nors would report a 7.6% decrease, even in the context of increased activity.

This effort was achieved through rationing Investments in fixed assets, maintaining the policy of investing only in assets needed for the operations activity. In working capital needs, we got a high decrease in absolute terms. This, along with the growth in activity, is reflected in the decline of working capital needs in sales days — from 18 days in 2018 to 10 days in 2019. This progress reflects our commitment to carefully affect our resources, thus allowing us to reduce the net operation debt and its consequent interest invoice.

net debt

We ended 2019 with a Net Debt with Lease Liabilities of 126.3 million euros, which directly impacted the application of IFRS 16 (33.8 million euros).

Regarding the Net Financial Debt (Financing obtained – cash and bank deposits -investments available for sale), Nors closed 2019 with 72.1 million euros, compared with 98.7 million euros in 2018 and 117.5 million euros in 2017. This pattern demonstrates our commitment to ensuring the solidity of our balance sheet.

4.2.2.1. nors mobility

In Portugal, the results were mostly positive. From a strategic point of view, and having as a primary goal to establish the future business model of our different companies, we continued to invest in diverse internal projects adapted to those companies’ specific needs.

In Brazil, 2019 was a year marked by exceptional results. These results were due to an increase in demand, a stable market share, an increase in prices, and an improvement in the mix of sold products. It should be noted that the sales volume recorded a 50% growth (8 percentage points above the market growth). Alongside this, the EBITDA of Auto Sueco São Paulo and Auto Sueco Centro Oeste doubled in value, registering its best result to date. Such success is justified by the increase in sales volumes and margins, by overhead expenditure reduction and — despite the considerable growth in turnover — by maintaining the Region’s Headcount. Finally, with a 60% reduction in financial charges and with the year closing without any bank debt, we noticed a robust evolution in the financial function. In Angola, we faced a particularly adverse macroeconomic and financial scenario. The strong devaluation of the Kwanza largely contributed to the market retraction, especially in the last quarter of the year.

To maximize profitability, we adjusted the structure of our different companies to the market needs. In the other African countries where we operate — Botswana, Namibia, and Mozambique —, 2019 marks another important milestone in the success trajectory, with historical results both in EBITDA and EBT. Auto Sueco Botswana and Auto Sueco Mozambique directly contributed to this achievement, with a particular reference to the additional 0.7 million euros in EBITDA obtained by Auto Sueco Botswana.

It should be pointed out that these companies attained, respectively, 7.9% and 9.8% of percentual EBITDA — results that transpire Nors’ best practices and reinforce their path of excellence and efficiency. We emphasize the debt management effort, which was the best achieved to date. It allowed us to close the year with 2.8 million euros worth of available funds, consolidating these countries’ extraordinary performance.

Auto Sueco Portugal

Auto Sueco is the exclusive distributor of Volvo trucks and buses, and Volvo Penta marine and industrial engines, for the Portuguese territory. Auto Sueco is also the exclusive dealer of Kohler-SDMO gensets in Portugal. Overall, Auto Sueco Portugal recorded a profitable year, documenting an improvement in profitability in new trucks sales and a 14.2% market share in heavy-duty trucks (≧16 tons). In the After Sales service, 2019 marked a generalized growth in retail and imports (+4% when compared to 2018) and the inauguration of a new Multi-brand Collision Centre for heavy vehicles in Gaia.

In its first year of activity, the latter not only added turnover but also managed to break-even. Besides, we reached a record value in operating results and industrial equipment sales — selling 27 Volvo Penta engines and 131 Kohler-SDMO gensets. Alongside the commercial activity, we continued with our two ongoing strategic projects that aim to define the company’s future business model — Customer Journey, which focuses on redefining the commercial model with the customer at its center, and Flow, directed for workshop efficiency.

Auto Sueco Angola

Auto Sueco Angola distributes Volvo trucks, buses, and cars in the Angolan territory, and is also a representative of the Kohler-SDMO gensets in this country. Considering the context of the Angolan market mentioned earlier, and as demonstrated by the analysis of the indicators, the overall results were challenging. The trucks’ market (≧16 tons) registered another fall, having dropped 26.8% since 2018, to 123 vehicles.

Nevertheless, Auto Sueco Angola managed to maintain its market share (+30%). Additionally, it should be noted that this company had an extraordinary performance in the Volvo car segment, having grown 400% in sales and 43.7% of the market share in the medium-high range, translating into a global market share of 3%.

Auto Sueco Centro Oeste and Auto Sueco São Paulo

Auto Sueco São Paulo and Auto Sueco Centro Oeste are Volvo trucks and buses dealers in Brazil, in the State of São Paulo, and States of Mato Grosso, Rondônia, and Acre, respectively. Brazil’s combined market — medium/heavy-duty trucks, and heavy-duty trucks — grew by 42%, reaching 74,495 units.

Still, it decelerated from a 60% growth in 2018 and represented 75% of the average market volume registered between 2010 and 2014. It should be noted that in the heavy-duty range, the market volume is now equivalent to the one from that period. However, in the medium/heavy-duty range, the market volume is still 50% from that maximum.

In light of this context, Auto Sueco São Paulo maintained its share in a state market that grew 35%, and Auto Sueco Centro Oeste managed to increase its share in the heavy-duty market by 1 percentage point, in a region that registered a 55% growth.

Auto Sueco Botswana, Auto Sueco Moçambique and Auto Sueco Namíbia

Auto Sueco Botswana is the exclusive representative of Volvo trucks and buses for this territory and the representative of trucks from Renault Trucks. Auto Sueco Namíbia holds the exclusive representation of Volvo trucks and buses in Namíbia, and trucks from Renault Trucks and UD Trucks. Auto Sueco Moçambique operates in the distribution of Volvo trucks and buses and SDLG construction equipment.

As shown by the indicators, all companies have significantly strengthened their market shares. In Botswana, we have achieved the best market share to date; in Mozambique, we kept our dominant position in the market. In Namibia, we substantially reinforced the second position of the Volvo brand. We highlight Auto Sueco Namíbia’s performance in the UD trucks range, obtaining a 4.6% market share in the heavy-duty range and 12.8% in the medium-duty range — thus recovering from the performance of 2018. In Auto Sueco Moçambique, we continued to implement the strategy of territorial coverage reinforcement by opening new facilities in Beira.

2019 is also the year that marks the beginning of the import and distribution of SDLG Construction Equipment, brand, and market segment, which we believe will play an essential role in its performance. It should be added that 2019 was an exceptional year for Auto Sueco Moçambique. It delivered 124 new Volvo trucks, with a total of 11.9 million euros, and 7 SDLG construction types of equipment, which represents 302.6 thousand euros.

Lastly, we have to mention the positive performance in the After Sales activity, with the Region growing 12% in total sales in the three markets. This growth was mainly driven by the 52% increase of Auto Sueco, and the stability shown by Auto Sueco Botswana and Auto Sueco Namíbia.

Auto Sueco Automóveis

Auto Sueco Automóveis is a car retail company with multi-brand dealers in Porto (Volvo, Mazda, and Honda), Lisbon (Volvo, Jaguar and Land Rover), Braga (Volvo), and Guimarães (Volvo). 2019 was a year of many achievements. Even though the return on capital employed was above what was initially planned, the EBITDA reflects the mentioned success — setting a record both in absolute value and margin. An essential part of the good results obtained by Auto Sueco Automóveis is the organization in the commercial area. Following the investment in resources that took place in 2019, we were able to focus exponentially on the channels where opportunities presented themselves. Furthermore, we capitalized on all possibilities for growth in the Volvo and Jaguar brands, without compromising commercial profitability.

In the After Sales service, we have achieved a growth in turnover in all of our locations. We also maintained our gross margins, which allowed us to leverage that growth into the business margin. In order to prepare the company for a new 5-year cycle, we invested, at a structural level, in 3 different areas: After Sales, Customer Service, and Digitalization. Regarding the first area, we reinforced our After Sales team management skills.

In the Customer Service area, we launched a project to implement a Global Call Centre — professionalizing the telephone assistance, facilitating contact, and ensuring that our Customers feel even closer to the company. As to Digitalization, we launched a “Digital Transformation” project for the business. We began by creating a new website, more adapted to the company, and the Customers’ current needs. Simultaneously, we set a new approach to Social Media, capitalizing on them to promote our products, services, and users’ engagement with our brand. Finally, we focused on achieving a more professional and faster project management.

Galius

Galius is the exclusive Renault Trucks distributor in Portugal. Galius’ year was marked by a significant decrease in the new trucks sale business due to the company’s commercial approach to the market.

In fact, with the considerable internal restrictions imposed on sales via rental, their weight in the sale of new vehicles dropped from 52% in 2018 to 36% in 2019. Regarding the heavy-duty trucks (≧16 tons) market share, we registered a drop from 14.9% to 11.9% in 2019. Besides that, the total market share fell 12% since 2018, according to the number of vehicle registrations. Compared to 2018, the medium-duty trucks (10 to 16 tons) market in Portugal has suffered a decrease in turnover. This is a natural trend in the market, taking into account that the high range offer broadly covers the Customers’ needs for solutions that in the past only existed in the lower range. In the After Sales service, we obtained, once again, positive results, growing 7% when compared to 2018.

In 2019, Galius began its involvement in the Moonshot project, within the scope of Nors’ innovation program, which started an engagement with numerous innovation initiatives, associated with the company’s different areas.

4.2.2.2. nors off-road

Nors operates in Angola, Brazil, and in every geography in which is indirectly present through its subsidiary, Ascendum. In Angola, despite the arduous macroeconomic scenario, 2019 was a positive year in this business area, highly based on the country’s mining activity performance. In Brazil, 2019 was a year of transition for the agricultural machinery business. However, it is important to note a shift in the company’s leadership by hiring a new Director, a change that we believe will enhance the operating results in 2020. The Ascendum Group, held in 50% by Nors, is one of the world’s largest suppliers of construction and infrastructure industrial equipment of Volvo Construction Equipment (VCE).

In addition to Portugal, it is present in Spain, USA, Turkey, and Mexico, and, with the expansion of its activity towards Central Europe in late 2013, it is also in Austria, Hungary, Czech Republic, Slovakia, Romania, and Croatia. In 2019, Portugal, Spain, and Central Europe managed to grow significantly. Nonetheless, the group’s global growth was affected by the circumstances in Turkey and Mexico, as well as by a bellow of expectations performance in the American market.

Ascendum

The Ascendum Group’s turnover in the Portuguese market increased by 13% compared to 2018, approximately reaching 183 million euros.

Spain

In Spain, and similarly to the previous four years, the consolidation of economic growth trajectory was seen in 2019, with the gross fixed capital formation in the construction sector estimated to have increased by 3.1% in 2018. Thus, in 2019, and comparing to the previous year, we witnessed a new increase in demand for construction equipment similar to the portfolio of products sold by Ascendum Maquinaria, an increase of around 19%. The Group’s turnover in the Spanish market totaled a rise of about 3% compared to 2018, reaching 130 million euros in 2019.

USA

In the USA, the Group achieved a 281 million euros turnover, representing a decrease of 6% compared to the 300 million euros recorded in 2018. This drop is justified both by the risk reduction strategy taken by the Group in 2019 which caused a 7% fall in the number of sold equipment—but also due to the aggressive strategies adopted by the competition.

Turkey

In Turkey, similarly to what happened in recent years, the activity was conditioned by a set of factors. Among them are some that stand out: the significant depreciation of the Turkish Lyra when compared to the main currencies (9.4% depreciation against the Euro); the high inflation that was around 15.7%; and the lack of liquidity in the financial markets. These events had a negative impact on billing, having the Ascendum Group’s turnover in this market registered a 49% drop compared to 2018, recording 76 million euros.

In 2019, the Central European operation achieved a turnover of around 188 million euros (8% above the 2018 turnover), being Austria (57% of the total turnover in Central Europe), followed by the Czech Republic (19% of the total turnover in Central Europe) and Hungary (7% of the total turnover in Central Europe) the main contributors. In Mexico, in 2019, Ascendum continued its strategy of consolidating the Mexican market operation, focusing on process improvement, optimizing the operational structure, and strengthening the skills of its employees.

Thus, and considering the macroeconomic and operational scenario is still not favorable for the Ascendum Maquinaria Mexico’s activity, in 2019, turnover decreased by 36% compared to 2018, being at around 21.1 million euros. In consolidated terms, the Ascendum Group’s turnover dropped 7% compared to 2018, standing at 878 million euros, and the EBITDA reached 84 million euros.

Auto-Maquinaria

Auto-Maquinaria is the distributor of construction equipment of Volvo Construction Equipment in Angola and is also the exclusive representative of Groove, Hyster, Epiroc, and SDLG products. The company’s sales rose 73.3%, a value mainly supported by gains in the mining sector’s market share.

Agro New

Agro New represents Case IH Agriculture in Catanduva and Votupuranga municipalities, in the interior of the State of São Paulo, with three main products: agricultural tractors, grain harvesters, and sugar cane harvesters, the latter being the primary product we sell in Agro New’s operating area. The company achieved better operating results in 2019, mainly due to the After Sales activity. In the future, we expect a stabilization in the market. Nevertheless, for 2020, we keep as a goal to increase our turnover by around 30%. This boost would be sustained both by the growth of the commercial performance in Tractors and Harvesters, as well as maintaining the growth rate of After Sales.

4.2.2.3. nors aftermarket

In Portugal, we have gone through a year full of challenges — mainly due to our companies internal restructuring and the merger of AS Parts into ONEDRIVE. We point out the CORE project’s implementation, which focused on efficiency, integration, and connection to the outside world, thus enhancing our future growth and profitability. In Angola, the scenario wasn’t a favorable one. To maximize profitability, we adjusted the structure of our different companies to the market needs. We expanded the services provided to our Customers, and the range of available products, allowing us to enter new complementary markets. In ONEDRIVE and Civiparts, we started selling tires and reinforced our product range with Wolf lubricants.

Civiparts Portugal and Civiparts España

Civiparts Portugal and Civiparts España distribute parts and workshop equipment for multi-brand trucks and buses. In Civiparts Portugal, it was a year with a commercial performance bellow expectations, not only as a result of the drop in turnover (-3.9% when compared to 2018) but primarily due to the loss of GM1 (-1.6 percentage points compared 2018). However, through the investment and implementation of a new customer service model by creating a national contact center (telephone and e-mail), we guarantee our leadership ability to tend to the market.

Civiparts España recorded a loss in turnover compared to the previous year (-5.8%) and a decline in profitability (-0.5 percentage points compared to 2018). On a positive note, the year was marked by the opening of a new warehouse in Madrid, allowing us to more than double the central storage area — from 1,000 square meters to 2,500 square meters. Both in Civiparts and Civiparts España, we began to prepare the CORE project, a Nors systems transformation project, reshaping the commercial and logistics models that will be implemented with the new IT system, in 2020. In the last quarter, we carried out a restructuring plan, part of a Nors regional strategy designed for both companies, whose primary goal is to improve the operating profitability.

ONEDRIVE

ONEDRIVE, integrated into the company Newonedrive, is responsible for multi brand car parts retail in Portugal and Angola. ONEDRIVE experienced a busy year. June was marked by the merger of AS Parts into ONEDRIVE and the start of the new ERP. Even though the latter had a negative impact on the results and disrupted sales and the logistics process, its implementation ensures a considerable improvement in our operational efficiency and service quality. Part of Nors’ regional strategy, a restructuring plan aimed to improve operating profitability was also implemented here.

Civiparts Angola and ONEDRIVE Angola

Civiparts Angola distributes workshop parts and equipment for multi-brand trucks and buses. ONEDRIVE Angola is responsible for the retail of car parts in this market. ONEDRIVE Angola and Civiparts Angola’s performance was significantly affected by the further reduction of the cars and heavy vehicles running population and the consequent drop in the demand of After Sales parts and services.

4.2.2.4. Nors Ventures

2019 was a defining year for Nors Ventures, which had a widespread growth in its companies. It’s worth emphasizing that, in line with our strategy of focusing on our core activity and the consequent disposal of non-core assets, we completed the sale of the Biosafe operation.

Sotkon

As of 2019, Sotkon is wholly owned by Nors. It’s a company that has several patented products that dedicates itself to the design, manufacture, and sale of modular systems for recycling systems, as well as of urban solid waste collection through underground containers. Sotkon is present in Portugal, Spain, France, Angola, and Turkey. The increase in sales presented by Sotkon was due to the Portuguese, French, and Turkish markets’ performance, and because of the international distributor’s network — Israel, Greece, Croatia, Lithuania, and Ukraine. Maintaining our fixed cost structure allowed an increase in operating EBITDA in proportion to the margin released by the sales success. The gross margin also showed a positive evolution as a result of the sales in the Portuguese and international markets, registering higher trade margins than other markets. As for the growth in the return on capital employed, it also derives from the extraordinary evolution of the EBITDA.

Amplitude Seguros

Amplitude Seguros is a full-service insurance and broker, operating in several economic segments and sectors. We maintained an organic and sustained business growth. This success is reiterated by the strengthened relevance of the market portfolio in the overall turnover. Despite the continued growth, we anticipate some challenges in the future for Amplitude Seguros. On the one hand, the insurance market’s growing concentration is causing additional difficulties on the insurance offer. On the other hand, we must adapt to more demanding administrative processes that arise from the increased GDPR and compliance requirements.

Vitrum

Vitrum positions itself in the Angolan market as the first company specialized in construction glass. In view of the particularly unfavorable macroeconomic and financial context and due to a sharp contraction in the construction activity, Vitrum’s results in the construction glass market were especially affected.